How To Get Money If Your Bank Is Closed

How to Get Money Orders and Other Urgent Items When Your Banking concern Is Closed

Need banking services later on hours? Attempt these options.

Most banks are just open during business concern hours, and the number of physical bank branches is dwindling as online banks take become more popular — the Wall Street Journal reported that 9,000 bank branches have closed across the U.S. in the past decade.

And so what do you do if you need to become a money order or cash a cheque when your bank is closed? Fortunately, you exercise have other options.

The Problem: Y'all Demand to Get a Money Order

Money orders tin can exist used as a substitute for greenbacks or checks when yous need to send money, and they're a safe choice if you lot'll be sending funds through the mail. They're a good option for people who don't have admission to personal checks or who want to ensure that the funds are secure. You lot might need a money gild if yous are paying bills or need to transport money to another person. Only what should you practice if you can't go to the bank to get ane considering it's outside of your branch'southward business hours? Become to the next slide for the solution.

Related: Banks Open on Sundays

How to Become a Coin Order When Your Banking concern Is Closed

If your bank is closed merely you demand to go a money order, head to Walmart. Y'all can purchase coin orders from whatever Walmart Supercenter or Neighborhood Marketplace at the customer service desk or Money Services Center. To become a money order at Walmart, you lot will need greenbacks or a debit card to pay for the money order and the money social club fee, which can be up to $0.88 depending on your location.

Y'all can as well ship money orders at many local supermarkets, pharmacies, cheque cashing locations and convenience stores through MoneyGram and Western Marriage.

Larn More: How To Make full Out a Money Order: A Pace-by-Step Guide

The Problem: Yous Need to Greenbacks a Check

Sometimes when you need greenbacks, y'all demand it immediately. If you have a check that you need to cash, but your depository financial institution co-operative is closed, you do have other options.

How to Cash a Check When Your Bank Is Closed

Waiting until your bank — or the bank the check was written from — is open is actually the best option, because yous won't have to pay a fee to access the funds. But if you demand the cash and can't wait until business hours to become information technology, there other other places you can get to greenbacks a bank check.

Your first instinct might be to head to a check cashing store, cash advance shop or payday loan shop, only these places tend to charge high fees. A better option is to greenbacks your check at a retail store similar Walmart or Kmart. Walmart charges a $4 fee for personal checks upwards to $1,000, and an $eight fee for checks between $1,000 and $5,000. Kmart has even lower fees, charging $1 or less, with no fees in many states for this service. Some supermarket chains also provide check cashing services.

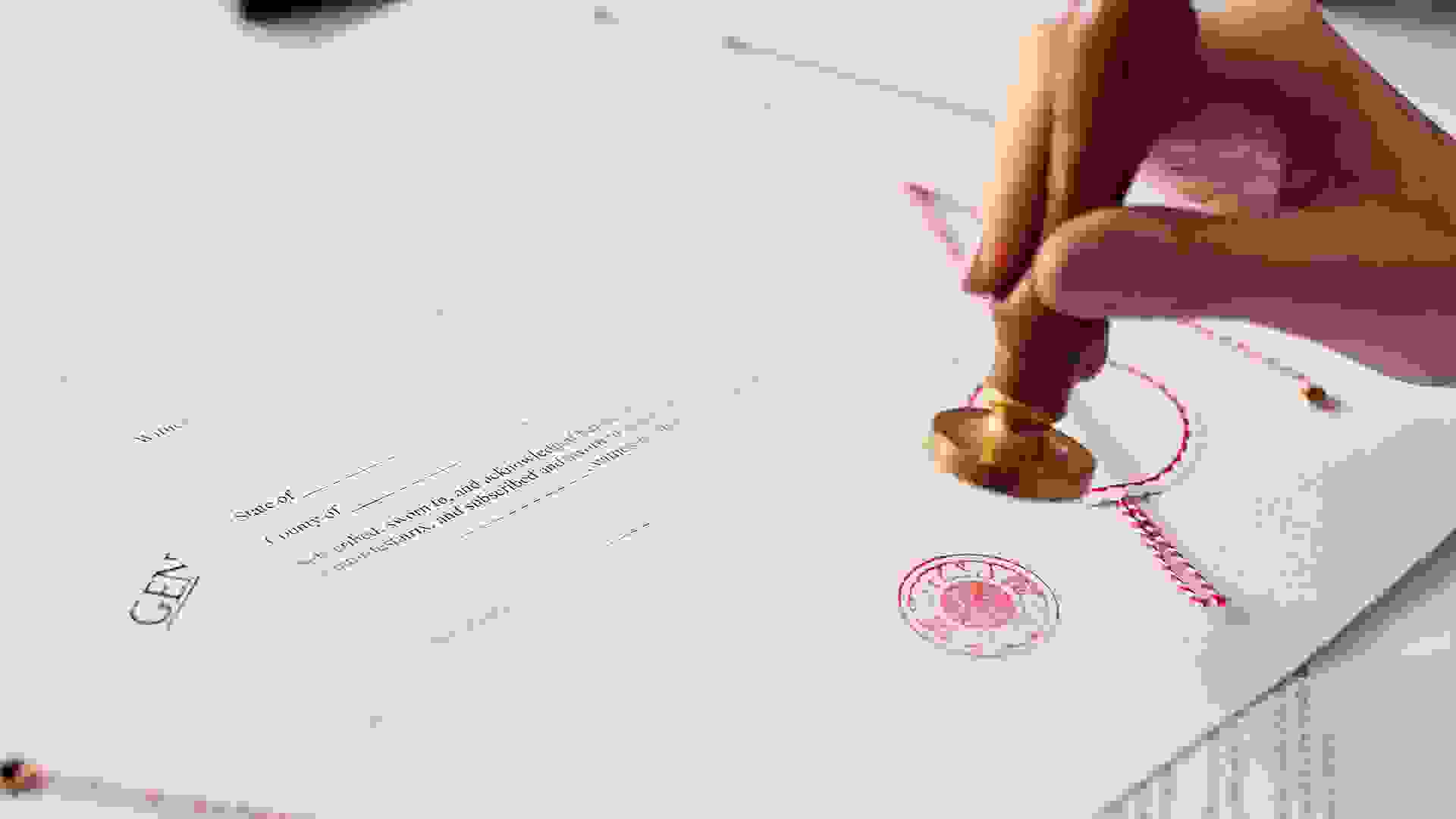

The Problem: Y'all Need Something Notarized

Some financial agreements — such equally mortgage endmost documents, property deeds or loan documents — require notarization, which means that an official 3rd party, called a notary, has witnessed you signing the document and verified your identity. Many people plough to concrete bank branches when they need a certificate notarized because this a service typically provided for free by your banking concern, but there are other options when you're in a pinch.

How to Get a Document Notarized When Your Bank Is Closed

There are other establishments that provide notary services that might be open at hours your bank is not. For example, UPS provides notary services, and some locations are open on Sundays. Y'all tin besides search for a notary public in your area, some of which provide their services 24/seven.

Another option is to get documents notarized through your phone with mobile apps like Notarize, which provides notary services 24/7, and allows you lot to go your certificate legally signed and notarized in just minutes.

The Problem: You lot Need to Deposit Coins

Yous tin can typically deposit cash and checks 24/7 at whatsoever ATM, but if yous want to deposit coins, you normally need to encounter a teller during bank hours. If you're itching to deposit the contents of your piggy bank right abroad, you don't have to look for your banking concern to be open if you know where to get instead.

Read: 30 Foreign Facts Yous Never Knew About Money

![]()

How to Deposit Coins When Your Depository financial institution Is Airtight

Yous've probably seen Coinstar kiosks at your local grocery shop but might accept been hesitant to apply them because they practice accuse a fee when you convert coins into cash. But yous can avert the xi.9 pct service fee when you convert your coins into an eGift Card instead. Coinstar allows you to turn your coins into a voucher that can be used at your pick of retailers, including Amazon, Best Buy, Chili'due south, GameStop, Starbucks, Home Depot and iTunes.

Don't Miss: 20 Other Subconscious Sources of Income Lying Effectually Your Business firm

The Trouble: Yous Demand to Accost a Serious Issue With Your Account

If you're having a serious issue with your account, such every bit beingness unable to withdraw funds from an ATM, or you spotted a transaction or balance that seems incorrect, it'southward useful to be able to talk to a depository financial institution representative face up-to-face up. If it'due south exterior of banking company hours, this might not be possible — but don't give upwards yet.

How to Address Serious Business relationship Issues When Your Banking company Is Closed

Meeting with a bank representative in-person might exist the platonic in this situation, merely if it's outside of depository financial institution hours, you can likely nonetheless become support via phone, email or online chat. Major national depository financial institution bondage like Wells Fargo offer 24/7 support to customers via phone and email.

The Trouble: Y'all Desire to Open up a New Business relationship

When you lot want to open a bank account — whether it'due south a new savings business relationship, checking business relationship, money market account or certificate of eolith — yous might adopt to head to a bank co-operative where yous can talk your options out with a representative, get easily-on assist with the awarding process and give your personal information in a style that feels secure. Simply you don't necessarily need to make a trip to your bank to do these things — there are easier options.

How to Open a New Account When Your Bank Is Closed

Many banks now offer the selection to open up a new account online and some even offer greenbacks incentives to do and so. For instance, you can become upwards to $350 when you open up a new Hunt Full Checking and Chase Savings business relationship online, and run across certain requirements. And fifty-fifty if you open up the accounts online, you can however take care of whatever banking needs you have at concrete branches during regular bank hours.

The Trouble: You Need to Make a Large Withdrawal

Y'all tin can withdraw as much money from your bank account as you want when you practise it in person, only there are often limits to how much yous tin withdraw from an ATM, which could make afterwards-hours withdrawals challenging. And then what practise you practice if y'all need access to a large corporeality of cash and your bank is closed?

How to Make a Large Withdrawal When Your Banking company Is Closed

If you need to withdraw more than money from an ATM than your maximum daily limit, you tin can call the bank and ask for a temporary increase in your daily assart. Typically, you would call the number on the dorsum for your debit carte to make this request.

If your depository financial institution doesn't grant your asking, there are other ways to go more greenbacks. With most banks, the maximum daily purchase amount you can make on a debit card is significantly higher than the ATM withdrawal maximum. So to get more cash, choose the greenbacks back option when you make a purchase at the store, and request the maximum amount. If you withal need more than cash, you can go a cash advance from a credit card. However, this should only be used as a concluding resort because doing this commonly comes with high fees and interest rates.

Don't Miss: Is Your Banking concern Open for Christmas? Find Out Here

The Problem: You Need to Wire Money

If you lot need to transfer funds from i account to another ASAP, a wire transfer is your best bet. Fortunately, there are many free ways to transport coin outside of banking company hours.

How to Wire Money When Your Bank Is Airtight

You can send money domestically for free by using mobile and online services like Venmo, Cash App, Zelle, Google Pay and PayPal. However, in that location is typically a ane- to three-business-mean solar day waiting period until the funds are attainable from the recipient'southward depository financial institution account. Venmo does allow the recipient to transfer funds to a debit card immediately but there is a 1 pct fee for this service.

You can also wire coin at your local Walmart shop. ThroughWalmart2Walmart Money Transfer, you can send money from i Walmart location to another, and the recipient will be able to pick up the coin in as little as 10 minutes. You tin can also wire money internationally at Walmart via MoneyGram. Both services can besides be accessed using the Walmart app or via Walmart.com. Note that at that place are fees to use these services.

More than on Banks

- 10 Best National Banks of 2019

- 10 Best Checking Accounts of 2019

- Coinstar Near Me

- Watch: 3 Banks With No Fees

We make money easy. Go weekly email updates, including expert advice to assist you Live Richer™ .

About the Author

Source: https://www.gobankingrates.com/banking/banks/how-to-get-a-money-order-bank-closed/

Posted by: whitesidesbegicke.blogspot.com

0 Response to "How To Get Money If Your Bank Is Closed"

Post a Comment